What Am I Worth in the Job Market?

An essential part of your job search is figuring out what your knowledge, skills, and abilities are worth in the job market. Many job seekers do not begin to try to understand this until they are called for an interview. When you update your resume and LinkedIn profile and research companies and network, you also need to understand what you can be expected to get paid. Knowing your worth in the marketplace is a crucial piece of information to understand. Without it, how do you know the right positions and companies to target to provide you with the compensation you require to meet your needs?

How Does A Company Determine Pay

Knowledge is power. Understanding how a company determines its pay structure is vital to understanding how to maximize your potential compensation, should you be made an offer. The first thing to know is that different industries will offer different pay scales. The Bureau of Labor Statistics, of which I am a proud alumnus, publishes the National Industry-Specific Occupational Employment and Wage Estimates. You can drill down into this data to better understand the differences between pay in 22 different occupations, such as Management, Sales and Related, and Business and Financial Operations.

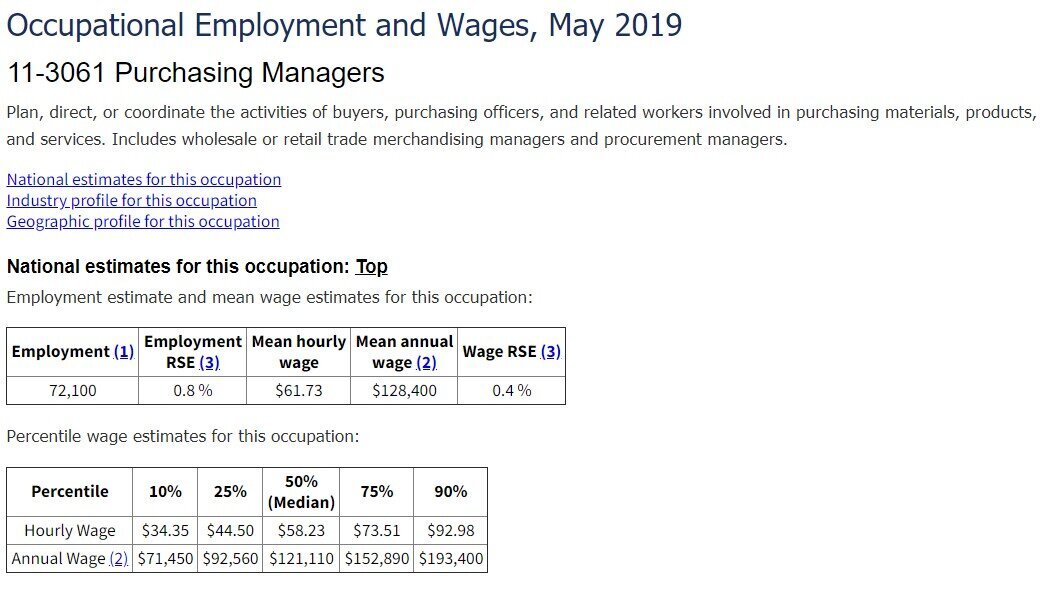

Below is a snapshot of the information for Purchasing Managers, under the Management Occupations.

Salary Ranges

Notice that the wage estimates for the Purchasing Manager are broken down on a range percentile? This range percentile is important information. Many job seekers looking at wage data often do not understand how to apply this to their situation. When the Bureau of Labor Statistics looks at all the wage data, they will get a wide range of numbers. This data reflects the broad types of businesses that employ someone with this title and job duties. Information could be from a small mom and pop business with ten employees to Fortune 100 employers. It can be organizations on the West Coast, in the Midwest or East Coast, with vastly different living costs. It can be business with those for which the Purchasing Manager title is their first job to those that have been doing this work for 30 years. When looking at this data, understand what the median represents. It is the middle of the data; 50% of the data points are above that number; 50% of the data points are below that number.

Compa Ratio

Many employers will contract with companies that provide compensation data (such as Payscale, Mercer, or Salary.com) to come up with salary ranges for a particular job with specified job duties in a specific location. Other factors applicable to determine the proper salary range for individual positions can include the company's size, revenue, whether there are people management duties, and even travel.

Sometimes there will be a lot of data for a specified job, and the compensation team will have an excellent idea about the market. Suppose the position is somewhat unique. In that case, the person in charge of compensation may have to find similar jobs and make additional comparisons to find the best indicator of the correct salary range. This often happens with a job that is a hybrid of several positions.

Once the compensation professional feels that the best match has been made for their specific situation, they will then look at the data and the different percentiles. To develop the company's salary range, the compensation professional will often start with the 50th percentile data, and widen the range to 20% on either side, so 80% to 120% of the median. With a senior executive, the range is often widened further, to 40% or even 60% on either side of the midpoint. With lower-level positions, the range may be narrowed to 10% on either side, so 90% to 110% of the median. The Compa ratio or range penetration are terms used in HR to reflect where a person's compensation (either base wage or total compensation) is within a range.

Below would be an example of how the Compa-ratio would be determined for a department with six Purchasing Managers.

Employee Title Base Pay Range Midpoint Compa-ratio

A Purchasing Manager 110,000 121,110 91%

B Purchasing Manager 125,000 121,110 103%

C Purchasing Manager 120,000 121,110 99%

D Purchasing Manager 118,000 121,110 97%

E Purchasing Manager 126,000 121,110 104%

F Purchasing Manager 121,500 121,110 100%

Some people are above the range midpoint; others are below the range mid-point. Generally, a Compa-ratio of 100% is where someone competent at their job should be. Someone transitioning to the role or with less experience would typically have a Compa-ratio below 100%, as they would not be considered fully competent in the role. Those with a Compa-ratio above 100% may be more tenured or exceptional performers who provide additional value to the organization. Unless you come into a position with a lot of transferable skills or relevant experience, you should not expect your Compa-ratio to be over 100%. If you come in at the high end of the range, there is not much room for you to grow compensation-wise. Most companies will not want to start you off in a situation where wage increases will be capped. Additionally, when several people are in the same position, the company would generally want to provide a compensation level that fits the current salary structure. They do not wish to pay you more than what is being paid to existing employees with the same experience and skills. That is a recipe for low employee morale.

Compensation Strategy

Also, many companies will have a compensation strategy that may influence the ranges they use for compensation for a specific job. Remember, a company would typically have a 20% differential around the median for a salary range. Some companies may have a philosophy that approaches this differently.

Companies often start with a compensation strategy based on their culture and organizational strategy. What does the company want to stand for, and what are the business's strategic goals? For a company concerned about knowledge retention, then paying higher than the market, so employees stay, could be part of the compensation strategy. On the other hand, if an employer wants to be the lowest-cost producer in their market and since labor costs are often the highest expense, then they may want to pay lower than market rates.

Supply and demand can also play a role in the compensation strategy. Market realities may mean that if the pool of qualified people for a role is smaller than in others, then the range for that position may be adjusted upwards. For example, instead of using the 50th percentile as the median, an employer could use the 60th or 70th percentile. The range would then be 20% on either side of that salary amount.

An employer may be providing services for a client, and that would include the people employed to provide the service. If there has been a contract negotiated with the client for a set fee, the employer has already priced in the labor costs for this service. An employer may be unwilling to budge from their wage cost estimate, which could mean less profit or even a loss on the project.

As you can see, many factors go into a company's salary ranges.

Do Your Research

What I have described is how a company with a formal HR process determined salary ranges. Of course, many companies are not as sophisticated with their compensation strategy. They may not get detailed compensation information from a compensation provider and instead rely on publicly available data, such as the BLS data. Or they may use data from previous job searches: the smaller the company, generally, the less rigorous the compensation process.

Candidate research is critical. Getting a picture of the worth of your skills, experience, and knowledge in the marketplace helps you to be able to determine what to tell an employer about your salary expectations. It enables you to negotiate from a stronger position when an offer is made.

Salary Information

Many places offer salary information. As already discussed, you have data from the Occupational Outlook Handbook, referenced above. As you can see, though, there often is a lag in when the data was collected. In some occupations, due to changing market conditions, that information may be out-of-date. It is an excellent place to start your research, though.

Professional associations are also an excellent resource for salary information. Many do yearly surveys to help their members understand changing wage rates. Often, though, you need to be a member to access this information.

Agencies also can be a source of information about salaries. They are working with clients, so have information about the salary ranges being offered for particular positions in specific industries. Many temporary help agencies also are third-part recruiters for permanent jobs. They will often publish salary ranges for positions within the areas they recruit for (finance, HR, IT) and publish this information yearly. This information is often given to their clients or potential clients, but if you can also get your hands on this information, it could prove to be helpful. Robert Half has a salary calculator available to the public that is based on these guides.

While not many companies post their wage rates, some do. If you can find enough data points from job ads, it could help determine what various companies are offering.

Networking is also a way to find salary information. More people are open about what they are being paid. If you know people with the same title you want and are comfortable asking, they can be a great resource. If you are networking within a target company, you may want to ask about its compensation philosophy and where they pay based upon the market. Suppose the position has also been posted internally. In that case, there may be more salary information given to present employees about the job, such as the grade level or even the specific salary range. If you can find this out, it will be a big help.

Salary Benchmarking Tool

There are several salary calculators available for free. The most well-known ones are Salary.com, Payscale.com, and Glassdoor.com.

Most start with you entering the job title and location.

You will then be asked to add additional information. Payscale will want to know why you want this information, whether it is for a current role, to evaluate a job offer, or to research salary information for a different position than what you have now.

You are first asked about the years of experience you have. It says either for your field or career.

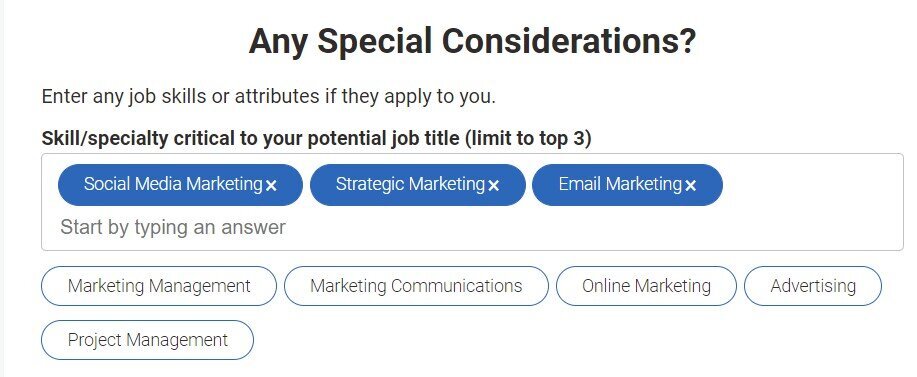

You are then asked for up to three additional skills you bring to the role. It asks you for the top ones.

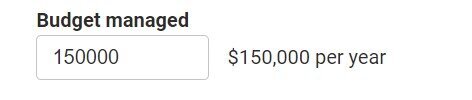

It then will ask for the scope of your budget management.

It then will ask you about your employment status.

Payscale will then ask you for information about a prospective employer. This is important to fill out because, as we discussed, salary ranges can vary depending on the type of employer.

For the type of employer, your choices include a government entity, a school, and a not for profit, among others.

For employer product/business, if you start typing, it will offer suggestions. If you type in Hospitality, it provides the choice of Travel and Hospitality Services, Hospitality Housekeeping Services, or Hospital Supplies, Wholesale.

If you know a specific company you are interested in, you can add it and whether it is public or private.

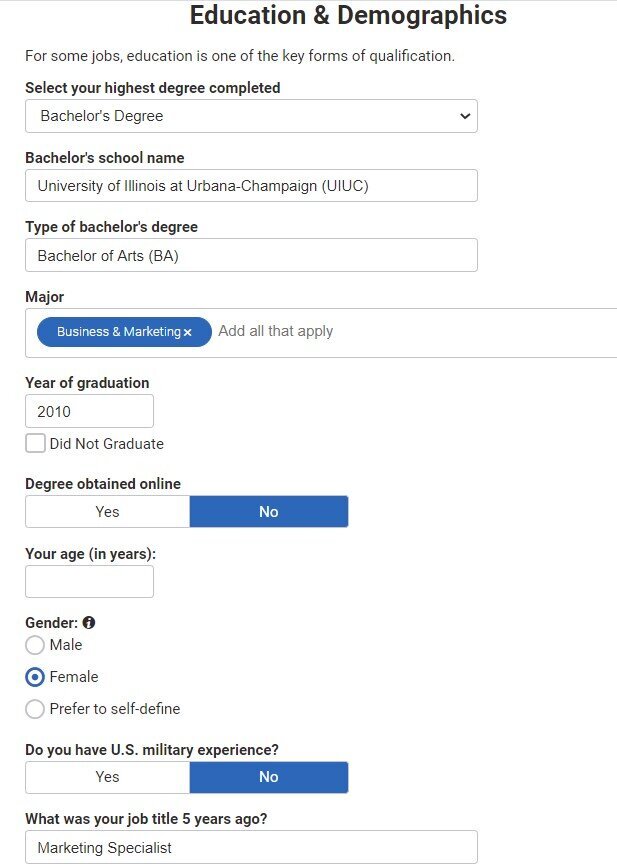

The next section to complete is for your education and some demographic information.

You are asked to complete the highest degree. Degree attainment can have an impact on salary. Unless you have not completed high school or only have a high school diploma, you will be asked for more information, including the school's name, the degree, and major. If you have completed a certificate program, you will be asked additional information about your certification and program.

You will also be asked about your year of graduation or attendance and whether you graduated. Depending on the degree or certification, you may be asked if it was completed online.

For demographic information, you can show if you are male, female, or self-defined. You will be asked about any military experience, and if the answer is yes, you will be asked additional questions about it. Lastly, you will be asked about your job title from 5 years back.

The next step is to see the results.

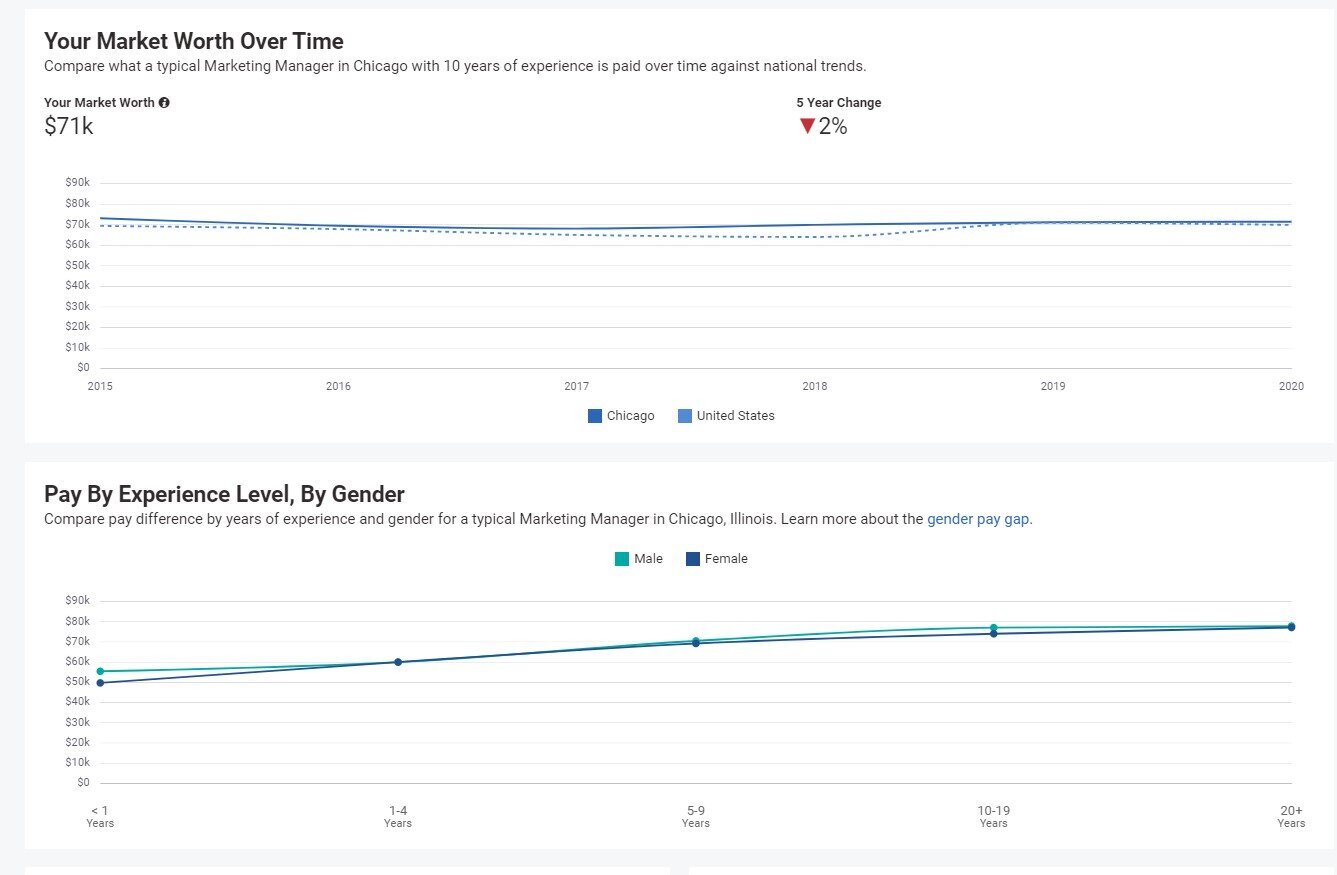

You will see two graphs. One is a bar with the market. It includes base salary, variable pay (such as bonuses), and other compensation forms relevant to this title. The second bar graph pulls out information just for variable pay, such as bonuses and profit-sharing.

You will also get additional information, such as your market worth over time, and pay by experience level, broken down by gender.

Lastly, they also provide information on additional skills that can impact pay and how much and location data for high and low-cost areas.

How To Use This Information

When using any of this information to understand your worth in the marketplace, several factors must be considered:

Are you using the right job description for comparison?

What company A determines are the job duties of a Marketing Manager, for this example may be different from what company B has for the job duties. I have seen where one company’s Marketing Manager equated to a Marketing Coordinator in another company - because the job responsibilities were so vastly different.

You cannot rely on the job title. When companies buy compensation information from a vendor, the job titles they look at will also have information about the role responsibilities, so that the best match can be made. Make sure you are comparing your background and experience to the right job. If you do not, you may be overestimating (or underestimating) your worth in the marketplace.

The Right Location Is Important

Hourly rates and salaries often are dependent on location. Minimum wage laws may be locality dependent, which dictates a floor for the rate of pay for hourly workers in that city or county. Sometimes in large metropolitan areas, salaries will be higher for businesses located in the city center than in far suburbs. Therefore, it may be helpful to compare wage information for a metropolitan area, such as Chicago, to a specific location, such as Aurora, Illinois. There may be a significant difference.

What Experience Level Does The Position Require?

In our example, the candidate had ten years of experience and was looking for what Marketing Managers with ten years of experience make. What if the job does not require ten years of experience but instead five? The candidate would then need to get data on what the market is dictating a Marketing Manager role with five years of experience should be paid. The median salary for Marketing Managers with five years of experience is lower.

At ten years of experience, the median compensation was $89,000. With five years of experience, it dropped to $78,000. If the company's salary range is 20% on either side of the median, then the company requiring only five years of experience would be paying within a range of $62,400 to $94,800. While you might expect that coming in with ten years of experience, you would be brought in higher than the median amount of $78,000, would you be brought in at $89,000, the median for someone with ten years of experience? That number is close to the top of the range. A company may be uncomfortable paying you that much if it leaves very little room for growth. You need to be aware of this and figure out your negotiation strategy if you want to work for the company requiring only five years of experience. If they cannot go higher on base salary, perhaps they can offer more vacation or access to additional training?

Understand Variable Pay

Many job seekers are focused solely on base pay, but that is a mistake. Variable pay can play a critical role in your compensation. A bonus opportunity can be very lucrative, depending on how the bonus is constructed. Ensure you understand the standard bonus components for jobs in your industry, so you have a benchmark. Suppose the bonus plan for an organization is very generous as compared to the market. In that case, you may be less concerned if the base salary is lower when you know you can easily make up the difference in variable pay.

Don't Exaggerate Your Skills

When looking at your worth in the job market, you must accurately assess your skills, especially technical skills. I have seen people pass themselves off as Excel experts when they are barely at an intermediate proficiency level. If you do not have a specific skill, that is okay; most candidates do not have every skill that a job description requires. Yet, when you are looking at your worth in the marketplace, don't overstate what you offer. The company will be assessing this and will only pay you for the value you actually will provide.

Conclusion

Before you get started with your job search, know your worth in the market. Do not be taken by surprise when asked what you want to make. Know your value by doing your research. Then you can say with confidence that your skills are worth a certain amount.

Here are additional tips for negotiating a job offer.

Shelley Piedmont is a job search coach. She wants to help job seekers put their best foot forward by providing the tools for a successful job search. If you need career coaching, resume preparation, interview skills assessment, or LinkedIn profile assistance, she can help. Schedule a 15-minute no-obligation consultation.